The European Council on Foreign Relations (ECFR), a major European thinktank, issued a new policy brief this week titled “EU differentiation and Israeli Settlements”(pdf), stating that the “Israeli matrix of control inside the OPT [occupied Palestinian territories]” cannot be included as part of bilateral EU–Israel ties. The brief goes on to say the EU and its member states have a “legal requirement to comply” with EU policy to differentiate between Israel and the occupied Palestinian territories in all bilateral transactions with Israel. This would include daily financial transactions and greatly impact Israel’s banking industry — which could ultimately threaten Israel’s economy, and lead to an “economic tsunami” of radical proportions.

Referencing the European Commission guidelines from 2013, the report states “differentiation” should be officially named, recognized and referenced “as a fully-fledged policy” in “official statements issued at the senior political level” and specifies that transactions between European states and financial institutions are obligated, based on international law, to adhere to policies of differentiation in their daily dealings with Israeli banks, businesses, and individuals regarding all settlement transactions.

Placing emphasis on the banking system, Reuters reports “The most significant proposal is on banking, where large Israeli institutions have daily dealings with major European banks, while also providing loans and financing to Israeli businesses and individuals based in the settlements.”

With the British government holding a controlling stake in some banks following the financial crisis, that would in theory prevent those banks providing financing to Israeli counterparts that have dealings in the settlements.

The issue extends into loans and mortgages. An Israeli with dual European citizenship should, in theory, not be able to use a settlement property as collateral for a European loan since Israeli-issued property deeds are not recognized.

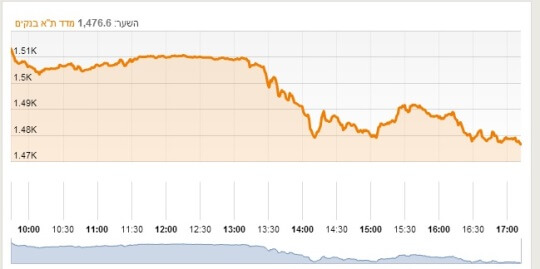

Israeli bank stocks plunged on the heels of the policy brief. +972’s Noam Sheizaf, reports the Tel Aviv bank index dropped following the release of the brief:

The degree of nervousness in Israel over possible measures taken against local companies who do business in the settlements was evident for all to see Tuesday, after a report by a EU think tank caused the Tel Aviv banking index to drop 2.3 points in less than an hour (a total of 2.46 points for the day).

Although ECFR’s brief states “European leaders should actively defend differentiation from increasingly forceful efforts by Israel’s political class to misrepresent and conflate EU actions with a boycott of Israel” and that the policy “does not stem from a desire to isolate Israel, but rather from deepening EU- Israel ties and EU legal obligations”, this is a stark reminder how the entrenchment of Israeli banks in the settlement enterprise makes it virtually inevitable the boycott of settlement products and businesses in the occupied Palestinian territories will include boycotting Israeli institutions.

There are other signs that the Israeli economy is vulnerable to BDS as well. A RAND study released in June, The Costs of the Israeli-Palestinian Conflict estimates the cost of peace (a two-state solution) would enhance Israel’s fortunes by $123 billion in a decade but “a return to violence” would have “profoundly negative economic consequences” — $250 billion over the next 10 years , with the Israeli economy losing some $250 billion in economic opportunities. Citing Rand economist Daniel Egel Haaretz reported “The lion’s share of BDS’s economic damage …would result from “investment flows” — decisions by capital funds, banks and so on to restrict the amount of money flowing to Israel. ”

In addition, the potential financial fallout on Israel’s economy from the impact of an international boycott was predicted and covered up by Israel’s Finance Ministry back in 2013. Initially the state refused to release the report and fought to hide the findings. Earlier this month, after a 2-year court battle, the Jerusalem District Court ordered Israel’s Finance Ministry to release its 6 page 2013 report (available in Hebrew here) assessing the economic impact of an expanded European boycott on the Israeli economy could reach NIS 40 billion($10.5 billion) annually. That’s a low 2013 estimate.

The judge read the report and determined the information wouldn’t harm the public.

Finally, a very recent report revealing foreign direct investment in Israel had dropped by 50% in 2014, which experts said was due to BDS and Israel’s slaughter in Gaza last summer.

Chickens coming home to roost. It’s been a very long time coming. Let’s hope the EU starts taking a more active role in carrying out their policies.

Annie, they wont do anything until the Israelis piss them of further but it get,s closer every day.Israel,s decision 2 days ago to build another 900 illegal squats and approve more so called (under Israeli law) illegal outposts is just another nail in the zionist coffin.

It,s their pockets that need to be hit and consequently their ability to finance illegal squats and continue mowing the lawn as well as fund the ongoing global charm offensive and the EU knows this but may be getting threats from the US administration to ease off.

Last week I posted a link to a story on J Post that stated that the GOI had forgiven loans to squatters to the tune of 135 milllion dollars , some of which had 90%of the original loan still outstanding even those loans were issued in the Seventies.These squatters have been living almost for free since then. More of the same is planned.

I had a look at ecfr’s list of experts and spotted Dimi Reider! 972? Actually, most of them are a young crowd.

The Foreign and Commonwealth Office has also issued its mid-year report on “Israel and the Occupied Palestinian Territories”:

https://www.gov.uk/government/publications/israel-and-the-occupied-palestinian-territories-opts-in-year-update-july-2015/israel-and-the-occupied-palestinian-territories-opts-in-year-update-july-2015

bah! can’t see why link won’t work! It does.

Great report on an extremely welcome development. The ECFR is saying in effect, “We’re not objecting to Israel existing, but we are objecting to its crimes”.

Israel’s banks treating stolen Palestinian land as part of Israel is nothing new. That started in 1948.

Greetings Annie,

You bring it on: Journalism with substance.

Appreciated fully.

ziusudra

PS There are laws to restrict bad behavior on everyone.

The purse sighs in despair easily being very delicate in nature.

You won’t hear a belch, but a puff of deflation.

“Chickens coming home to roost”. Well, there are all kinds of chickens here. Recommendations is one thing, and the EU boycott threats is already a long saga, but in the end it will come to a moment of truth, which is no other than: will or will not German corporations and banks boycott Israeli corporations and banks?

Germany is the clear boss of the EU – if it wants it can block or delay (forever) anything – and even if now there is a good (and “morally justified”) case to punish the Jews in Israel (there is no other way to present that since Israel defines itself as the Jewish State) – would not doing that be still quite problematic for Germany?

Consider the parallel Greek drama – for too many what`s going on there brings up bad memories but Germany feels that it has no choice because of compelling macro finance and political reasons. Now what would be the parallel crucial reasons to do something that will surely garner similar reactions? Exacerbating an image problem that Germany cannot be happy about.

So the saga is moving on but let`s see what happens when it comes to the true crunch?