Today is Earth Day and just yesterday the Earth Day Network, a global environmental coalition with 22,000 partners in 192 countries, cut ties with SodaStream over its relationship to the Israeli occupation. The US Campaign to End the Israeli Occupation sent out a press release with the news:

Earlier this month, SodaStream, which markets its home carbonating devices as a green alternative to bottled beverages, announced the launch of an awareness-raising campaign centered around the Great Pacific Garbage Patch. Several articles reported that this “Secret Continent” campaign was developed with Earth Day Network (EDN), which works with more than 22,000 partners in 192 countries to broaden, diversify, and mobilize the environmental movement.

Groups in the United States and abroad mobilized in opposition to the partnership between EDN and SodaStream due to the company’s complicity in Israel’s military occupation, including the destruction that Israeli settlements have caused to the Palestinian environment. In response, EDN’s logo has been removed from the Secret Continent website and EDN no longer lists SodaStream as a sponsor.

“This Secret Continent campaign is a clear example of SodaStream attempting to greenwash its complicity in Israel’s occupation through a public relations stunt. SodaStream appeals to customers by marketing itself as environmentally friendly, but a product manufactured in an illegal settlement on occupied land cannot be ‘green.’ We applaud Earth Day Network for listening to the thousands of concerned individuals who contacted them and sending the message that companies profiting from human rights abuses have no place in the global environmental movement,” said Ramah Kudaimi of theUS Campaign to End the Israeli Occupation.

PENGON, the Palestinian Environmental NGOs Network, added: “We are happy to see that Earth Day Network cut ties with the Israeli settlement manufacturer SodaStream. Israeli occupation and its settlement enterprise are not environmentally friendly. On the contrary, they are based on the pillage of our land and deplete and pollute our water resources. Over the last 40 years, the Israeli occupation has cut hundreds of thousands of trees to make space for their colonization. We call on all environmental organizations and activists to stand with us against the Israeli occupation and its systematic large scale destruction of our land.”

In related news, SodaStream’s occupation profiteering continues to make headlines in the U.S. The investment site The Motley Fool reported on recent rumors that SodaSteam is set to be bought but warned “A SodaStream Partnership Won’t Be an Easy Sell.” Rich Duprey writes for the site that the company “comes with baggage”, their illegal settlement factory is “a touchstone for controversy” and that potential partners including Pepsi, Dr. Pepper and Starbucks need to consider the “backlash of negativity by becoming a partner with SodaStream.”

From the article:

After an Israeli daily newspaper reported that SodaStream International (NASDAQ: SODA ) was mulling over a partnership with a major beverage company, shares of the stock surged 8% as speculation surged over who the suitor could be. Although it seems inevitable someone would want to hook up with the company, because it’s the leader in home-based soda making, SodaStream comes with baggage the Keurig Green Mountain and Coca-Cola pairing never had to contemplate, so I’m not certain lightning’s about to strike twice.

Regardless of whether you think it’s valid criticism or not, SodaStream’s operations in an Israeli settlement in Palestine are a touchstone for controversy. Actress Scarlett Johansson’s appearance in a Super Bowl ad for the DIY soda maker sparked an uproar earlier this year and led her to step down from a major anti-poverty organization that criticized her promo.

Whether you agree the West Bank settlements in Gaza are illegal or not is really beside the point, though it obviously colors your opinion of a company that operates from there or does business with one that is, and it’s just that kind of polarization that will make corporate boardrooms skittish. So investors trying to read the tea leaves over which “major beverage company” is planning on partnering with SodaStream, assuming there really is one, also must calculate whether the company will want to be dragged into a debate with all the negative connotations, publicity, protests, and boycotts that will come with it.

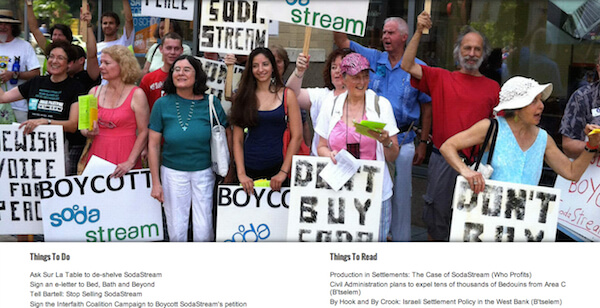

Many companies will be feeling the heat today as Earth Day protests against SodaSteam are planned around country. One will be outside Zabar’s on New York City’s Upper West Side from 5 to 7 p.m.

Here’s the word on the protest from Adalah-NY and the protest’s Facebook page.

“I didn’t think you were worth it.”

—Owner Saul Zabar, when asked why he did not grant our meeting requestLet’s show him that it’s worth it to stop profiting from occupation! Join the NYC Coalition Against SodaStream* in front of Zabar’s on Earth Day to demand that Zabar’s stop selling SodaStream products.

SodaStream, the Israeli-owned water carbonation device, is made in a factory in an illegal Israeli settlement on Palestinian land. SodaStream appeals to customers by marketing itself as environmentally friendly, but a product manufactured in the occupied West Bank—where water is funneled to the settlements and Palestinians are left with only a quarter of what Israelis can use—can’t be “green.” Help us celebrate Earth Day at a fun demonstration featuring songs, bubbles, and petition gathering to show Zabar’s that there’s nothing green about stealing land and resources.

*The NYC Coalition Against SodaStream includes Adalah-NY: The New York Campaign for the Boycott of Israel; Jewish Voice for Peace—NYC Chapter; Jews Say No!; and Park Slope Food Coop Members for BDS.

Finally, be sure to check out this cool new website from JVP Seattle promoting the SodaStream campaign – www.burstthebubble.org.

(h/t Stephanie Westbrook)

great news from EDN.

JVP new website is top notch, really impressive layout.

Sodastream could greatly enhance its salability/market cap by simply moving its factory to a Palestinian area of the WB. But they won’t do that. You have to ask why.

Short of an actual answer, you have to conclude that their current illegal location/activity is much more important to management than increasing shareholder value. (Or a possibly distant second, that the Israeli government/US taxpayer is subsidizing SS enough to compensate SS shareholders for this hit.)

That’s the definition of a non-viable biz (i.e. failure).

No one will invest in that short of a complete change in management and management philosophy.

Bravo Greenies!

En fin!

Zionists murder humans and olive trees en mass:

http://visualizingpalestine.org/infographic/Olive-Harvest

Thank you, thank you, thank you for finally officially voicing the colossal link between israeli’s brutal occupation and it’s catastrophic impact on Palestinian land.

“… a product manufactured in an illegal settlement on occupied land cannot be ‘green’.”

“This Secret Continent campaign is a clear example of SodaStream attempting to greenwash its complicity in Israel’s occupation through a public relations stunt.”

http://endtheoccupation.org/article.php?id=4013

There you have it, Miss Scarlett Johansson: straight from the Green horse’s mouth. Maybe now you eat these words you so infamously uttered:

[Sodastream] “has the ability to make a huge difference, environmentally.”

http://www.haaretz.com/news/diplomacy-defense/1.578563

And how about this old tickler: “I’m not an expert on the history of this conflict, and I’ve never professed to be. But it is a company that I believe in, that I think has the ability to make a huge difference, environmentally.

http://www.telegraph.co.uk/culture/film/starsandstories/10658713/Scarlett-Johansson-I-really-felt-like-I-was-on-a-hunt.html

LOL! Eat them words, Scarlett – eat BDS shorts with a dash of bitters and a sprinkle of salts – eat eat eat or denounce! Repent!

Off topic:

“The Campaign to End Ben and Jerry’s Business with Israeli Settlements”

http://www.counterpunch.org/2014/04/22/the-campaign-to-end-ben-jerrys-business-with-israeli-settlements/

Starbucks is already sold on the settlements — so buying SodaStream may not seem like much of a change for the brand.